Underwriting-as a-service

Hybopay’s Lending AI Underwriting-as-a Service is a cutting-edge, AI-driven solution designed to help financial institutions and digital lenders streamline their underwriting process.

By leveraging real-time risk assessment, instant decision-making, and personalized loan recommendations, Hybopay reduces operational costs while enhancing efficiency and accuracy.

Key Business Benefits

✔ Up to 70% Cost Reduction – Automating underwriting significantly cuts down labor, operational, and compliance costs.

✔ 10x Faster Loan Approvals – AI-powered instant decisioning accelerates approvals, improving borrower experience.

✔ 50% Improvement in Loan Approval Rates – More approvals through personalized lending strategies and alternative data usage.

✔ 40% Lower Default Rates – AI-driven risk assessment ensures smarter credit decisions.

✔ Seamless Customer Experience – Faster, personalized lending enhances customer satisfaction and loyalty.

Hyper-Personalization in Lending

Hybopay’s hyper-personalization leverages AI and machine learning to tailor loan offerings, risk assessments, and customer experiences to individual borrowers. By analyzing real-time data, behavioral patterns, and alternative credit indicators, Hybopay ensures that lenders can provide the right loan products at the right time, maximizing approvals and reducing defaults.

Hyper-Personalization in Lending

✔ Higher Loan Approvals & Expanded Customer Base

✔ Tailored Loan Products & Real-Time Offer Adjustments

✔ Enhanced Borrower Experience & Retention

✔ Real-Time Credit Risk Monitoring & Dynamic Adjustments

✔ 40% Lower Default Rates – AI-driven risk assessment ensures smarter credit decisions.

✔ Increased Revenue & Operational Efficiency for Lenders

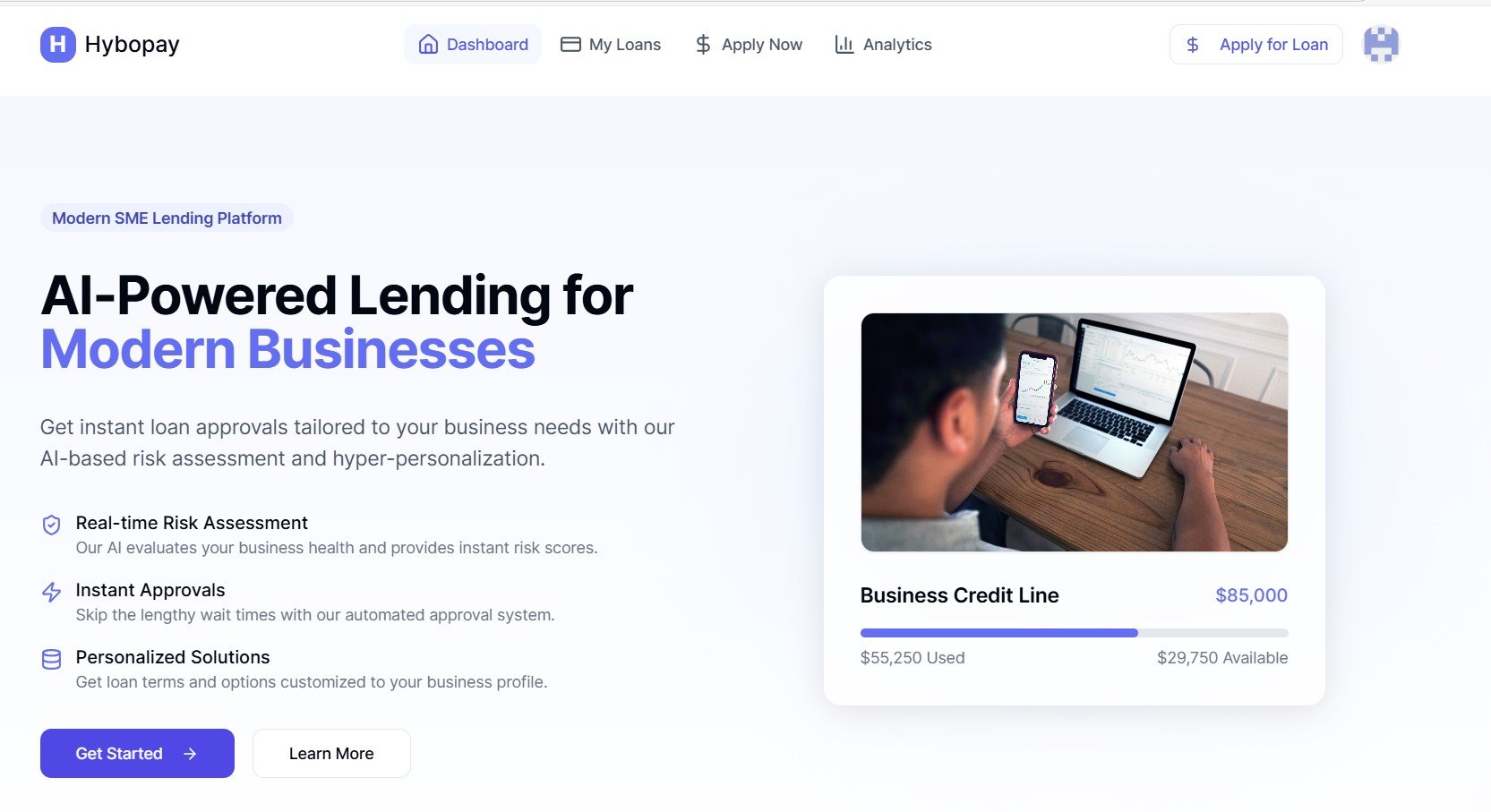

SME Lending AI

Hybopay’s SME-Lending leverages AI and machine learning to tailor loan offerings, risk assessments, and customer experiences to individual borrowers. By analyzing real-time data, behavioral patterns, and alternative credit indicators, Hybopay ensures that lenders can provide the right loan products at the right time, maximizing approvals and reducing defaults.

Benefits SME Lending AI

✔ Real-time Risk Assessment

Our AI evaluates your business health and provides instant risk scores.

✔ Instant Approvals

Skip the lengthy wait times with our automated approval system.

✔ Personalized Solutions

Get loan terms and options customized to your business profile.

✔ Increased Revenue & Operational Efficiency for Lenders

BNPL AI Lending

Hybopay’s A Buy Now, Pay Later (BNPL) Lending AI provides multiple benefits for lenders and midsized banks, helping them streamline operations, reduce risks, and expand their customer base. Here’s a detailed breakdown:

Just Released! Our official workshop to level up from UiCore Framework 4 to 5.

Just Released! Our official workshop to level up from UiCore Framework 4 to 5.